In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-23 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)10/18 Report--

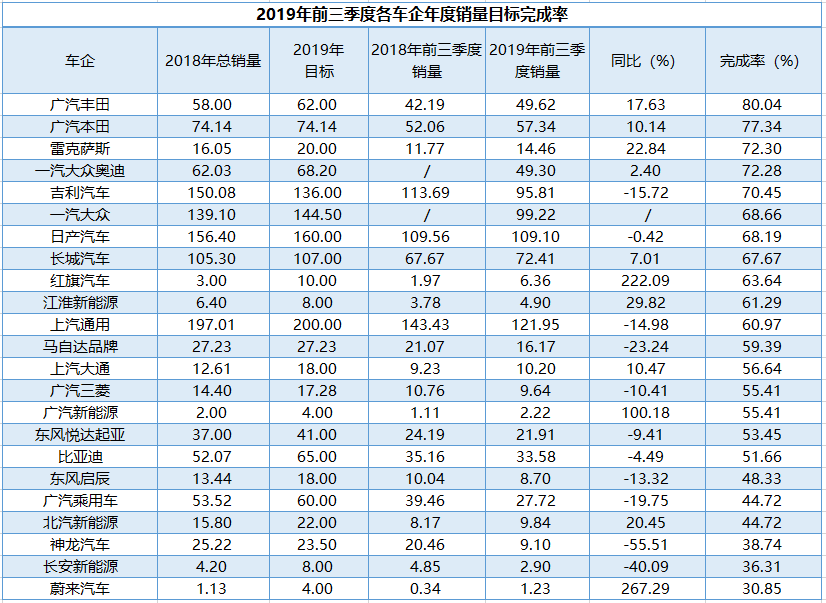

With only three months to go before the end of 2019, wholesale and retail sales of passenger cars in China declined in September, but by a narrower pace than before, according to data released by the Federation of passengers. So, what is the annual sales completion rate of China's car companies after the end of the third quarter? Next, let's take a look.

(the above table includes only some car companies, some of which have not announced their annual sales targets and are no longer within the scope of statistics.)

In terms of joint venture brands, Japanese cars Guangzhou Auto Toyota and Guangzhou Automobile Honda currently have the highest completion rates among the joint venture brands, reaching 80.04% and 77.34% respectively. Among them, GAC Toyota sold a total of 496200 vehicles in the first three quarters, an increase of 17.63% over the same period last year. From this, it seems that GAC Toyota wants to achieve its annual sales target of 580000 vehicles. Guangzhou Auto Honda sold a total of 573400 vehicles in the first three quarters of this year, an increase of 10.10% over the same period last year, mainly due to the high growth of the 10th generation Accord sales.

The sales of the Mazda brand in September were quite surprising. In September, Mazda sold 20619 vehicles in China, an increase of 16.30% over the same period last year. In the first three quarters, Mazda sold a total of 161700 vehicles, but the current annual sales completion rate is less than 60%. It is still very difficult to complete.

In addition, Dongfeng Yueda Kia accumulated sales of 219100 vehicles in the first three quarters, with target sales of 53.45%, GAC-Mitsubishi's cumulative sales of 99800 vehicles, target sales of 57.70%, and DPCA's cumulative sales of 91000 vehicles, less than 40%.

In terms of independent brands, except for Geely, Great Wall and Red Flag, which accounted for more than 60% of the annual sales targets in the first three quarters, other car companies are very likely to fail to meet this year's sales targets.

Geely sold 958000 vehicles in the first three quarters, down 15.72 per cent from a year earlier, but has achieved 70 per cent of its annual sales target of 1.36 million vehicles.

Great Wall sold 724000 vehicles in the first three quarters, up 7 per cent from a year earlier and meeting its annual sales target of 1.07 million vehicles. Great Wall Motor sold 100000 new cars in September, up 15.33% from a year earlier.

Red Flag cars are the dark horse in recent months, with sales reaching 11570 units again in September, up 188 per cent from a year earlier and 15.5 per cent month-on-month. Cumulative sales in the first three quarters of this year reached 63600, accounting for 63.6 per cent of annual sales.

Judging from the current market situation, the polarization of independent brands is becoming more and more serious. The sales of Geely and Great Wall have been able to compete with joint venture brands, while some relatively weak independent enterprises are erratic in the wind and rain.

Dongfeng Qichen, an independent brand of Dongfeng Group, set an annual target of 180000 vehicles, but sold only 87000 vehicles in the first three quarters, achieving only 48.33 per cent of the target.

In terms of new energy brands, in terms of completion rate, Jianghuai New Energy has the highest completion rate of 61.29%, with cumulative sales of 49000 vehicles in the first three quarters, an increase of 29.82% over the same period last year, followed by GAC NE, which achieved 55.42% of the sales target. The cumulative sales in the first three quarters were only 22200 vehicles, but an increase of 100.18% over the same period last year.

What is worth paying attention to is BAIC New Energy. BAIC New Energy sold 158000 new vehicles last year. BAIC New Energy has raised its sales target to 220000 vehicles this year, but the current completion rate is not optimistic. A total of 98400 vehicles were sold in the first three quarters, only 44.72% of the annual sales target. It seems that after the subsidy goes downhill, it will have a great impact on BAIC's new energy.

In addition, the cumulative sales of Lulai in the first three quarters was 12300 vehicles, an increase of 267.29% over the same period last year, but only 30.85% of the annual sales target was achieved. From this, it seems that it will be difficult for Lulai to meet its sales target this year. Entering 2019, the dilemma that Lulai faces is not only that it cannot meet its annual sales target, but also that there are more auto spontaneous combustion, plummeting share prices, internal layoffs and a setback in investor confidence than the crisis of failing to meet its sales targets. fortunately, sales improved in the third quarter of this year, reaching 4799 vehicles, an increase of 47 per cent year-on-year.

According to the HKIFA analysis, September and October are the traditional peak season for cars, but September sales obviously do not meet expectations, and a pick-up in October is to be expected. In addition, manufacturers are expected to continue to optimize the inventory structure of dealers in the fourth quarter. shorten the departure cycle and provide more attractive auto finance solutions to unleash retail potential.

However, there is still the last quarter before the arrival of 2020, whether there can be a breakthrough, but also need to be combined with the fourth quarter new car planning, promotion model and other means.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.