In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)10/21 Report--

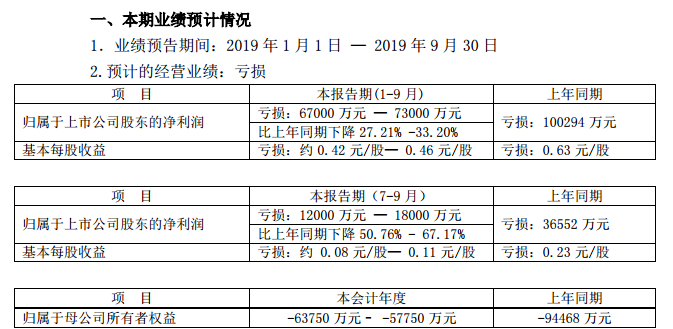

A few days ago, Tianjin FAW Xiali Automobile Co., Ltd. issued a forecast of results for the first three quarters. According to its announcement, FAW Xiali expects the net profit and loss attributed to shareholders of listed companies to be 670 million yuan to 730 million yuan in the first three quarters, down 27.21% and 33.20% compared with the same period last year. Of this total, the loss in the third quarter is expected to be 120 million to 180 million yuan, down 50.76% and 67.17% compared with the same period last year.

In fact, FAW Xiali has not made a profit since it deducted its net profit in 2012. According to the data, from 2014 to 2018, the net profit of FAW Xiali deduction is-1.737 billion yuan,-1.18 billion yuan,-1.677 billion yuan,-1.666 billion yuan,-1.263 billion yuan,-1.263 billion yuan, five years. FAW Xiali accumulated losses of more than 7.5 billion yuan.

In the five years of losses, FAW Xiali had to sell its property in order to ease the financial pressure. FAW Xiali sold 15% of FAW Toyota, internal combustion engine manufacturing division, transmission branch, product development center and automobile research center, etc., but the sale of household property also led to a sharp decline in FAW Xiali sales.

During the five-year period from 2014 to 2018, 72000, 64900, 36900, 27100 and 18800 vehicles were sold respectively, with a total of 219700 new cars sold in the five-year period. According to this calculation, FAW Xiali loses 3424 yuan for every car it sells.

Of course, at least for this car company, there is another thing that many new car makers want, and that is production qualification.

FAW Xiali said in the performance forecast announcement that the company's loss was mainly due to the overall decline in auto market sales, as well as the company's products due to brand weakening, positioning and configuration deviation, weakening sales channels and many other factors, the company's product sales remain in the doldrums. At present, the company is actively promoting the joint venture with Nanjing Bojun New Energy Automobile Co., Ltd.

Matters.

On April 29 this year, FAW Xiali announced that it will set up a joint venture in Nanjing Bojun New Energy vehicle Co., Ltd., and the two sides are jointly committed to the new energy vehicle market. On September 27th, FAW Xiali again announced that the two sides had signed a joint venture agreement to set up a joint venture company, Tianjin Boxun Automobile Co., Ltd., with a registered capital of 2.54 billion yuan. FAW Xiali's assessed and documented vehicle-related land, plant, equipment and other assets and liabilities were valued at 505 million yuan, with a shareholding ratio of 19.9%. Nanjing Bojun New Energy Automobile contributed 2.034 billion yuan in cash and held 80.1% of the shares.

After landing, FAW Xiali will no longer "produce cars alone", but will develop the Boxun brand with the new car-building force Boxun Automobile, so FAW Xiali has embarked on the journey of "new energy vehicles" through Boxun, but it is not easy to build new cars with high sales!

It is worth noting that there are certain risks in the cooperation between FAW Xiali and Boxun Automobile. According to the FAW Xiali announcement, if the joint venture company fails to obtain the automobile production qualification within 6 months after its establishment, unless it is caused by Boxun Automobile, Boxun Automobile has the right to unilaterally rescind the shareholder Agreement and dissolve the joint venture company.

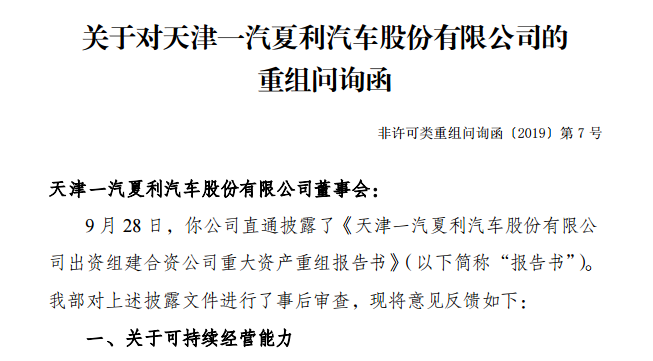

In addition, FAW Xiali received a letter of inquiry from the Shenzhen Stock Exchange on the establishment of a joint venture with Boxun Motor Co., Ltd. In the inquiry letter, the Shenzhen Stock Exchange asked FAW Xiali to explain such issues as the main business of FAW Xiali after the completion of the transaction, the company's sustainable operating ability, and whether it competed with the controlling shareholder in the same industry, and asked FAW Xiali to reply before October 25. FAW Xiali has not responded to this.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.