In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)10/30 Report--

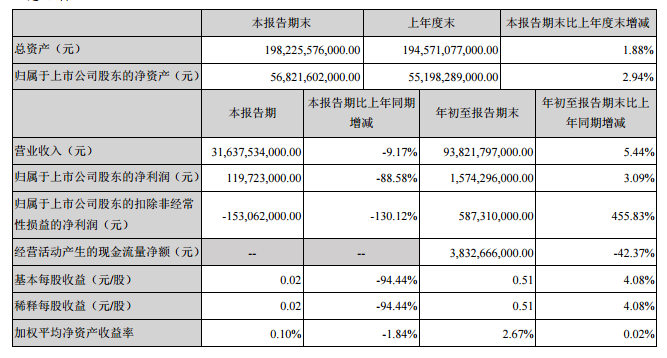

According to the data, BYD achieved operating income of 31.638 billion yuan in the third quarter of 2019, down 9.17% from the same period last year; the net profit of shareholders belonging to listed companies was 120 million yuan, down 88.58% from the same period last year; operating income in the first three quarters was 93.822 billion yuan, an increase of 5.44% over the same period last year The net profit attributed to shareholders of listed companies was 1.574 billion yuan, an increase of 3.09% over the same period last year.

It is worth noting that this is the first growth in the first three quarters of BYD in nearly three years. In 2016, BYD's net profit in the first three quarters rose 86.82% from a year earlier, while in 2017 and 2018, net profit in the first three quarters fell 23.82% and 45.3% from a year earlier. In addition, the performance in the first three quarters of this year is also far lower than that in the first half of the year. In the first half of this year, BYD's operating income was 62.184 billion yuan, an increase of 14.84 over the same period last year, and the net profit belonging to shareholders of listed companies was 1.455 billion yuan, a sharp increase of 203.61 percent over the same period last year.

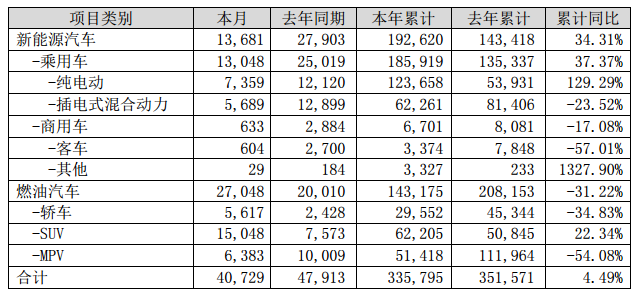

BYD's cumulative sales in the first three quarters of this year were 335800 vehicles, down 4.49 per cent from a year earlier, according to sales data. Among them, the cumulative sales of new energy vehicles were 192620, up 34.31% over the same period last year, and the cumulative sales of fuel vehicles were 143175, down 31.22% from the same period last year. BYD aims to sell 650000 vehicles in 2019, of which 420000 are new energy vehicles. By the end of September, the completion rate of BYD's sales target was 51.66%, and that of new energy vehicles was 79.95%.

From the sales data, the growth trend of BYD new energy vehicles is much faster than that of traditional fuel vehicles, but in the case of the rapid growth of BYD new energy vehicles, the net profit has declined, which is completely opposite to the trend of sales growth. BYD explained that mainly due to the decline in subsidies for new energy vehicles and changes in the structure of sales products, the net profit for 2019 is expected to be 15.84-1.774 billion yuan, down 36.19% from the same period last year to 43.03%. In other words, net profit will decline again in the fourth quarter compared with the third quarter.

Overall, BYD's sales growth in the automotive business has slowed slightly, but it is still above average in the industry, and new energy vehicles have been among the best in the Chinese market.

Among the top 10 new energy vehicles released by the China Automobile Association in September, BYD has four models, namely, BYD Yuan EV, BYD Song Pro, BYD e2 and BYD Tang DM. It is worth mentioning that BYD Song Pro has been selling well since its debut in July, selling 12716 vehicles in August and 15039 in September.

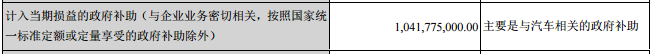

Although the growth rate of net profit declined in the first three quarters, it still increased. The industry believes that BYD's profit growth in the first three quarters has something to do with subsidies for new energy vehicles.

In the first three quarters of this year, BYD received a total of 1.042 billion yuan in government subsidies. On October 12, the Ministry of Industry and Information Technology announced the announcement on the liquidation and examination of subsidy funds for the promotion and application of new energy vehicles in 2017. the amount of money approved by BYD was 3.159 billion yuan. The company said in the announcement that the recovery of the subsidy funds liquidation will significantly accelerate the company's accounts receivable turnover, increase the company's cash flow, further reduce interest expenses, reduce financial expenses and the company's asset-liability ratio.

From the perspective of the current automobile market, affected by the decline of subsidies for national sixth and new energy vehicles, the auto market is still in a state of decline. Xu Haidong, assistant secretary-general of the China Automobile Association, believes that the future of the car market is not optimistic. On the whole, the automobile market environment has not really warmed up and is expected to decline next year.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.